Meanwhile, here are kittens:

GOP-linked punk rock ministry says executing gays is ‘moral’

You Can Run But You Cannot Hide, Inc., a 501(c)3 nonprofit ministry that brings its hard rock gospel into public schools, has been deepening its long-running ties to the Republican Party of Minnesota. Long a cause célèbre for Rep. Michele Bachmann, who has twice lent her name to the group’s fundraising efforts, You Can Run (YCR) had a booth at the GOP convention in April, and the group’s frontman, Bradlee Dean, reports that gubernatorial candidate Tom Emmer recently accepted an invitation to visit with him at Dean’s home.

You Won't Believe The Stupidity Of The Latest Attack On Walmart

If you thought Mayor Bloomberg’s failed assault on certain large sodas sold in certain kinds of stores was arbitrary and capricious, get ready for a similarly bizarre attempt to punish large retailers.

The salvo is called the Large Retailer Accountability Act (LRAA), but just think of it as yet another effort from the DGDP: the Department of Good Deeds Punishment.

For its sin of providing millions of working class Americans with good service, broad selection and low prices, Walmart might as well have painted a (Target-style) bullseye on itself among progressives.

In order to punish this good deed, though, the rebarbative chairman of the D.C. City Council, Phil Mendelson, has been pushing an extraordinary new law that would apply only to large national retailers, with more than $1 billion in sales, who open D.C. stores of greater than 75,000 square feet.

Such firms would be required to pay a “living wage” of at least $11.75 an hour to all employees

. . . a “living wage” of at least $11.75 an hour to all employees — a 62 percent premium over the federal minimum wage. D.C. already has its own super-minimum wage of $8.25 an hour (set by law at $1 above the federal minimum).

So the LRAA is a super-duper minimum wage proposed mainly to punish a single company, which is why wags in the press are calling it the Walmart Living Wage Bill.

And the answer is: Walmart is way ahead of you. In its D.C. push, which has been underway since at least 2002, Walmart has thoughtfully gone around making the kinds of “donations” to politically-connected figures that wedding guests gave the Corleone family.

It put on its payroll the treasurer and campaign manager of a key city council member, Yvette Alexander. It invited neighborhood activists to a focus group that paid $100 and dinner. It spent hundreds of thousands of dollars on local charities like the Greater Washington Urban League and D.C. Hunger Solutions. It arranged a healthy-foods photo-op with Michelle Obama. And it spent in the “eight-figure range” (in the estimate of one journalist) to sponsor a traveling exhibition on the African-American experience that was led by NPR host Tavis Smiley, who proceeded to praise Walmart at the swanky opening-night party amid many influential black leaders.

You’d think a business that not only plays by the rules (without asking for tax and zoning breaks)

a business that not only plays by the rules (without asking for tax and zoning breaks) but is a beloved icon for the working class and goes to considerable lengths to be a good corporate citizen

And even in statist D.C., there is recognition that an efficient free market, unlike the city’s sclerotic bureaucracies, is a near-miraculous method for lifting people up.

Has liberalism run amok under President Obama?

Much attention has been given to growing extremism in the GOP — but critics say progressives are just as bad.

Since President Obama's convincing re-election victory, the dominant political story has centered on whether the GOP should counter right-wing elements within its party and undertake moderate reforms that many argue are necessary for Republicans to return to power

But while a proposed Republican makeover has grabbed all the attention — see the much-publicized "autopsy" this week of Mitt Romney's November defeat — developments within the Democratic Party have largely escaped the microscope.

David Brooks, the center-right columnist at The New York Times, argues that liberals have, in fact, lurched leftward under Obama.

There is a statue outside the Federal Trade Commission of a powerful, rambunctious horse being reined in by an extremely muscular man. This used to be a metaphor for liberalism. The horse was capitalism. The man was government, which was needed sometimes to restrain capitalism’s excesses.

Today, liberalism seems to have changed. Today, many progressives seem to believe that government is the horse, the source of growth, job creation and prosperity. Capitalism is just a feeding trough that government can use to fuel its expansion.

For an example of this new worldview, look at the budget produced by the Congressional Progressive Caucus last week. These Democrats try to boost economic growth with a gigantic $2.1 trillion increase in government spending — including a $450 billion public works initiative, a similar-size infrastructure program and $179 billion so states, too, can hire more government workers.

Today, progressives are calling on government to be the growth engine in all circumstances. In this phase of the recovery, just as the economy is finally beginning to take off,

these Democrats want to take an astounding $4.2 trillion out of the private sector and put it into government where they believe it can be used more efficiently.

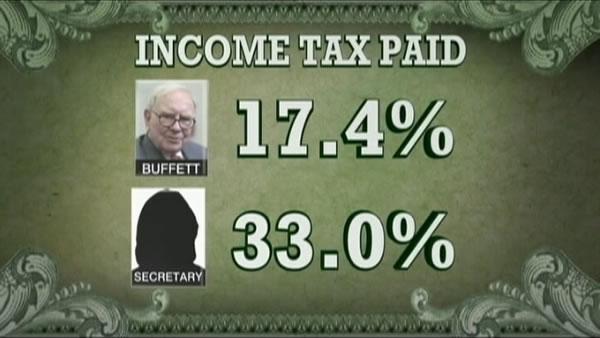

How do the House Democrats want to get this money? The top tax rate would shoot up to 49 percent. There’d be new taxes on investment, inheritance, corporate income, financial transactions, banking activity and on and on.

Now, of course, there have been times, like, say, the Eisenhower administration, when top tax rates were very high. But the total tax burden was lower since so few people paid the top rate and there were so many ways to avoid it. Government was smaller.

Today, especially after the recent tax increases, the total tax burden is already at historic highs. If you combine federal, state, sales and other taxes, rich people in places like California and New York are seeing the government take 60 cents or more out of their last dollar earned.

The first problem, of course, is that there aren’t enough rich people to cover even the current spending plans. As an analysis by the group Third Way demonstrated, even if we threw every semiplausible tax increase at the rich, the national debt would still double over the next three decades.

The second problem is that if you set the tax burden at astronomical levels you really do begin to change behavior and wind up with a very different country. You don’t have to be a rabid supply-sider to believe that when you start taking away 80 percent or 90 percent of somebody’s top marginal earnings, you are going to get some pretty screwy effects.

Higher taxes will produce long-term changes in social norms, behavior and growth. Edward Prescott, a winner of the Nobel Memorial Prize in economics, found that, in the 1950s when their taxes were low, Europeans worked more hours per capita than Americans. Then their taxes went up, reducing the incentives to work and increasing the incentives to relax. Over the next decades, Europe saw a nearly 30 percent decline in work hours.

“The actor who played Satan, Mehdi Ouzaani, is a highly acclaimed Moroccan actor. He has previously played parts in several Biblical epics – including Satanic characters – long before Barack Obama was elected as our President,” said Burnett and Downey.

“This is utter nonsense.”

BRIDENSTINE: Just because the Supreme Court rules on something doesn’t necessarily mean that that’s constitutional. What that means is that that’s what they decided on that particular day given the makeup of the Court on that particular day.

DUNLAP, Calif. (AP) — A 24-year-old intern who was described by her father as a "fearless" lover of big cats ventured into a lion enclosure at a privately owned zoo and was mauled to death, prompting investigations by several government agencies that want to know how the accident happened.

"Can you imagine a circumstance where an AR-15 would be a better defense tool than, say, a double-barrel shotgun?" Graham asked. "Let me give you an example, that you have an lawless environment, where you have an natural disaster or some catastrophic event -- and those things unfortunately do happen, and law and order breaks down because the police can't travel, there's no communication. And there are armed gangs roaming around neighborhoods. Can you imagine a situation where your home happens to be in the crosshairs of this group that a better self-defense weapon may be a semiautomatic AR-15 vs. a double-barrel shotgun?"

[Eric] Holder pointed out that the senator was "dealing with a hypothetical in a world that doesn't exist."

"I'm afraid that world does exist," Graham insisted. "It existed in New Orleans, to some extent up in Long Island [after Hurricane Sandy], it could exist tomorrow if there's a cyber attack against country and the power grid goes down and the dams are released and chemical plants are -- discharges."

"What I'm saying is if my family was in the crosshairs of gangs that were roaming around neighborhoods in New Orleans or or any other location, the deterrent effect of an AR-15 to protect my family, I think, is greater than a double-barrel shotgun."